Are you wondering How Much Should You Contribute To 401k to secure a comfortable retirement? Determining the right 401k contribution amount can be a complex decision, but HOW.EDU.VN is here to provide expert guidance. Our comprehensive guide will help you understand contribution limits, employer matching, and other crucial factors. By optimizing your retirement savings strategy, you can build a solid financial future with the help of our team of over 100 renowned PhDs at HOW.EDU.VN. Maximize your retirement savings, plan your financial future effectively, and explore retirement planning strategies today.

Here are the five intentions that people search for this keyword:

- Determine the percentage of salary for 401k contributions.

- Understand the impact of employer matching on 401k contributions.

- Find out if you are maxing out the 401k contributions or not.

- Strategies for optimizing 401k contributions based on personal financial goals.

- Know the consequences of over-contributing to a 401k.

1. Understanding 401(k) Contribution Limits

What are the annual contribution limits for 401(k) plans, and how do they affect your savings strategy? The IRS sets annual limits on 401(k) contributions to ensure fair tax advantages. Understanding these limits is crucial for planning your retirement savings effectively.

1.1. What is the Maximum Amount I Can Contribute to My 401(k) Each Year?

For 2025, individuals can contribute up to $23,500 to their traditional and Roth 401(k) accounts combined, as per the Internal Revenue Code (IRC) Section 402(g). If you’re 50 or older, you can contribute an additional $7,500, totaling $31,000 due to catch-up contributions. Beginning in 2025, those aged 60-63 can contribute an extra $11,250, for a total of $34,750. These limits are reviewed annually by the IRS and adjusted for cost-of-living changes.

1.2. Does the Limit Include Employer Contributions?

No, the individual contribution limit only applies to what you contribute from your paycheck. The total amount that can be contributed to your 401(k), including your contributions and any employer contributions, is $70,000 in 2025. This total limit increases to $77,500 for those 50 and older, and $81,250 for those aged 60-63 eligible for the extended catch-up. Additionally, your 401(k) contributions cannot exceed 100% of your taxable income.

1.3. Multiple 401(k) Plans and Contribution Limits

If you have access to more than one 401(k) in a single year, the deferral limits still apply to all your contributions combined. The limit doesn’t reset if you switch jobs.

Consider these scenarios:

- Scenario 1: In 2025, a 39-year-old works for Company A from January to September and contributes $10,000 to their 401(k). They then switch to Company B from October to December. They must inform Company B’s 401(k) provider about the previous contributions to avoid exceeding the $23,500 limit.

- Scenario 2: A 53-year-old works full-time for two companies with 401(k) benefits and takes on a seasonal part-time job that also offers a 401(k). If they are already contributing $23,500 to their 401(k)s through Company A and Company B, any additional contributions to Company C’s 401(k) cannot exceed $7,500 (based on the IRS catch-up contribution limits for 2025).

1.4. Rollover Funds and Contribution Limits

Whether rollover funds count toward your contribution limit depends on the tax year of the original contribution. Contributions made in the same tax year count toward your limit, regardless of whether they are rolled over. If you roll over funds from a previous 401(k) where the contributions were made in a prior tax year, that balance does not count toward your annual limit.

For example, if you worked at Company X from April 2023 to April 2024 and then joined Company Y in May 2024, contributions made from April 2023 to December 31, 2023, do not count toward your 2024 limit, even if you roll them over to your Company Y 401(k) in 2024 or later.

1.5. Consequences of Exceeding Contribution Limits

Contributing above the IRS-allowable amount can result in double taxation. The IRS imposes taxes on excess deferrals to ensure fair use of tax-advantaged 401(k)s. This often occurs when individuals don’t inform a second 401(k) provider of prior contributions.

Guideline monitors your activity and notifies you if you exceed your limit based on the deferrals they are aware of.

2. Maximizing Employer Matching Contributions

How can you take full advantage of employer matching contributions to boost your retirement savings? Employer matching is a significant benefit that can substantially increase your retirement savings. Understanding how it works and how to maximize it is essential.

2.1. Understanding Employer Matching

Employer matching involves your employer contributing to your 401(k) based on your contributions. This is essentially free money that can significantly boost your retirement savings.

2.2. Common Employer Match Formulas

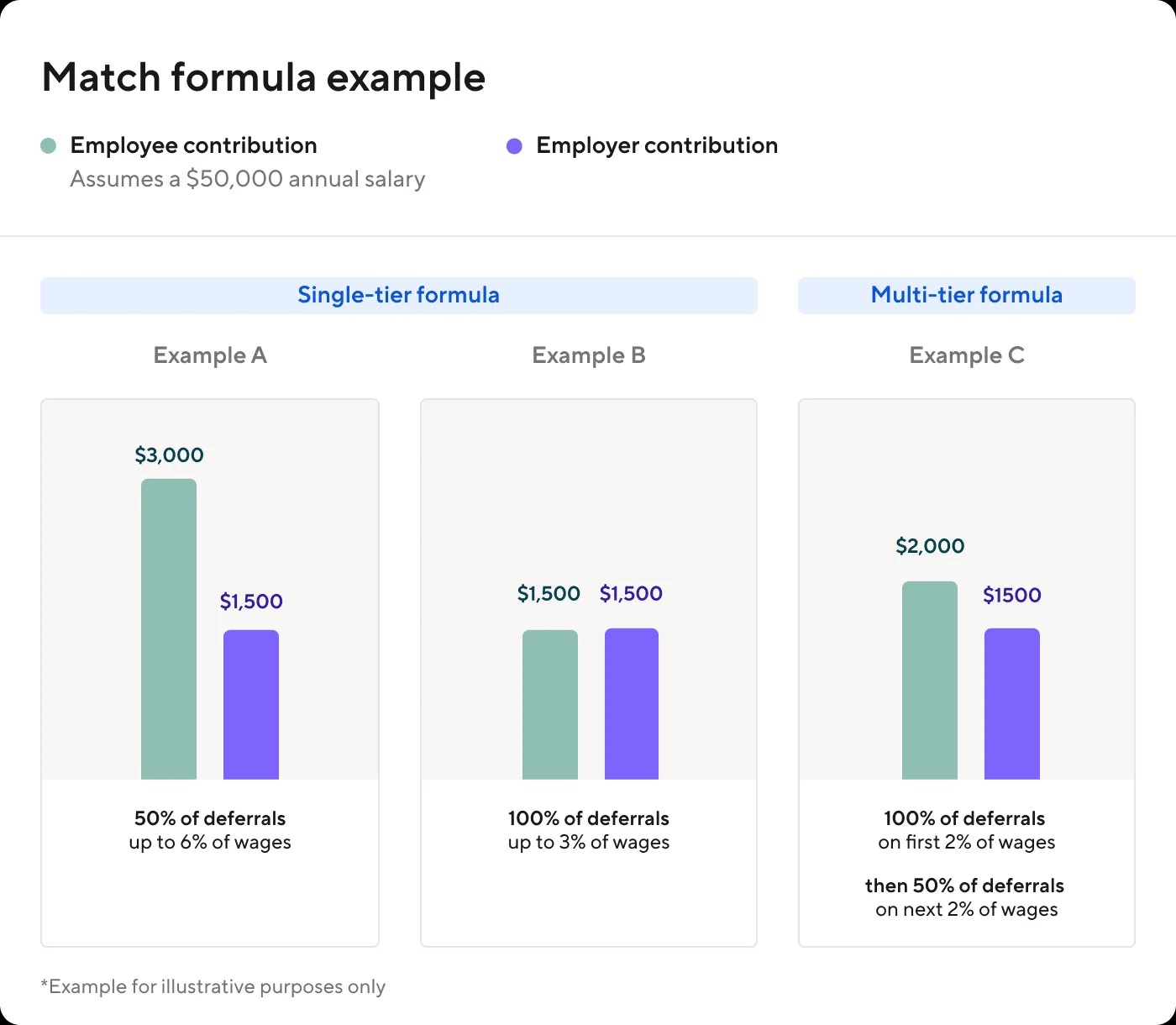

Employer matching can take various forms, so it’s crucial to understand your plan’s specifics:

-

Single-Tier Formula: The employer matches a fixed percentage of your contributions up to a certain percentage of your income.

- Example A: Your employer matches 50% of the first 6% of your contributions. To get the full match, you need to contribute at least 6% of your income. Here, the employer matches $.50 for every $1 you contribute, up to 6% of your income.

- Example B: Your employer matches 100% of the first 3% of your contributions. To get the full match, you need to contribute at least 3% of your income. In this case, the employer matches $1 for every $1 you contribute, up to 3% of your income.

In both cases, the employer’s match is 3% of your income, but in Example A, you need to defer at least 6% to get the full 3% match.

-

Multi-Tier Formula: The employer’s match has different tiers, with each tier matched at different ratios.

- Example C: Your employer matches 100% on the first 2% and 50% on the next 2%. You need to contribute at least 4% to get the full match of 3%. Here, the employer matches $1 for every $1 on the first 2% contributed, and $.50 for every $1 on the next 2%.

In this example, too, the employer’s match is 3% of your income, but you need to defer at least 4% to get the full 3% match.

Match formula example

Match formula example

Contributions beyond what’s required to earn the employer’s match will not result in a higher match.

2.3. Importance of Meeting the Match

Think of your employer’s contribution as part of your total compensation. Contributing the minimum amount to earn the full match is crucial. Not doing so is effectively leaving money on the table.

For example, if your income is $50,000 and you don’t contribute enough to meet the match, you could be missing out on up to $1,500 in employer contributions each year.

2.4. Contributing Beyond the Match

You can contribute more than the match to save more for retirement and take advantage of tax benefits. However, contributions beyond the match will not earn additional matching funds.

2.5. Vesting Schedules and Employer Matching

The matched amount may not be fully yours immediately if your employer has a vesting requirement. Vesting schedules determine when you have full access to your employer’s match.

- Immediate Vesting: You have immediate access to your employer’s match.

- Cliff Vesting: You unlock the full amount of your employer’s match after a predetermined period, such as two years.

- Graded Vesting: You gradually unlock a portion of your employer’s match each year you are employed. For example, with a 2-year graded vesting, you might unlock 50% after the first year and 100% after the second year.

If your 401(k) plan has a vesting requirement and your match is not fully vested when you leave your employer, only the employer’s match is affected. Your contributions, including gains and losses, are always yours to take.

3. Determining the Right Contribution Amount for You

How do you determine the ideal 401(k) contribution amount that aligns with your financial situation and goals? Determining the “just right” amount to contribute to your 401(k) involves assessing your financial situation, goals, and employer match. There’s no one-size-fits-all answer, but here are key considerations.

3.1. Meeting Your Employer Match

Always prioritize contributing at least enough to meet your employer’s match. This is essentially free money that significantly boosts your retirement savings. Not doing so is equivalent to not earning your full salary. While this may reduce your take-home pay, consider the long-term growth potential of your retirement account from compound returns.

3.2. Contributing More Than the Match

If you’re comfortable contributing more than what’s required to earn your match, consider doing so. While you won’t get additional employer contributions, you’ll save more, take greater advantage of tax-advantaged accounts, and benefit from compounding returns. This small change today can create a significant impact come retirement.

You can change your contribution amount at any time, allowing flexibility for unexpected expenses.

To determine how much more you can contribute:

- Examine Your Expenses: Add up your average monthly expenses, including rent or mortgage, utilities, food, and entertainment. Also, include any student loans or credit card debt payments.

- Chart Your Goals: Consider retirement alongside other milestones like buying a home, raising children, going on vacations, and unplanned expenditures like medical bills.

- Explore Your Options: Retirement savings accounts are part of a broader financial portfolio. Explore other savings and investment options that fit your needs and adjust as your plans evolve.

Consider these factors that can impact your financial journey:

- Overall risk tolerance

- Investment objective

- Overall financial situation

- Outside investment and retirement accounts

- Prior investment experience

- Tax bracket

- Time horizon

3.3. Maxing Out Your 401(k) Contributions

If you’re able to contribute the maximum, that’s great, but be mindful of timing.

If you have an employer match, maxing out too early in the year can lead to missing out on a portion of your employer’s match. Once you max out, your employer’s match will stop as well. Your Guideline account’s contribution setting page will alert you if your contribution amount will push you into this territory, allowing you to adjust your deferral amount and get the most value from your 401(k) each year.

If you’re already contributing the maximum allowable amount to your 401(k) ($23,500 in 2025, $31,000 if you are 50+, and $34,750 if you’re 60-63) and looking to save more with a dedicated retirement account, consider contributing to an IRA. IRAs offer similar advantages to a 401(k) and allow you to contribute an additional $7,000 ($8,000 if 50+) in 2025. Contribution limits and considerations are based on your income.

4. Key Takeaways for Optimizing Your 401(k) Contributions

What are the essential points to remember when determining how much to contribute to your 401(k)? To make informed decisions about your 401(k) contributions, keep these points in mind:

4.1. Meet Your Match

By not contributing the minimum amount required to meet your match, you are effectively leaving money on the table. While it may not seem consequential today, when you consider the effect of compound returns, a few percentage points today can in theory grow into a meaningful sum by the time you retire.

4.2. Optimize Your Max

If you have an employer match, don’t max out too early in the year, as you may leave some of your match on the table.

4.3. Don’t Exceed the Max

Be mindful of the annual contribution limit, especially if you have access to more than one 401(k) account in a single tax year. Over-contributing requires you to return the excess amount in due time to avoid paying taxes twice and avoid a 10% penalty. Depending on when this takes place, you may need to request a new W2 to ensure your taxable income is correct on your tax return.

4.4. Strike the Right Balance

Finances are an incredibly personal topic. Consider your bigger picture — as detailed or as broad as you’re comfortable with — and what other financial commitments you may have up ahead. You can change your contribution amount at any time. So, if you’ve decided to contribute 10% but you have an unexpected financial expense and need to scale back for a few months (but not below your match of course), that’s certainly allowable.

5. Advanced Strategies for 401(k) Contributions

What are some more sophisticated strategies for maximizing your 401(k) contributions and overall retirement savings? Beyond the basics, several advanced strategies can further optimize your 401(k) contributions and retirement savings.

5.1. Roth vs. Traditional 401(k) Contributions

Decide whether to contribute to a Roth or traditional 401(k). Traditional 401(k) contributions are made pre-tax, reducing your current taxable income, but you’ll pay taxes on withdrawals in retirement. Roth 401(k) contributions are made after-tax, so you won’t pay taxes on withdrawals in retirement.

Your choice depends on your current and expected future tax bracket. If you expect to be in a higher tax bracket in retirement, a Roth 401(k) may be more beneficial. Conversely, if you expect to be in a lower tax bracket, a traditional 401(k) might be better.

5.2. Mega Backdoor Roth

If your plan allows, consider a mega backdoor Roth conversion. This strategy involves making after-tax contributions to your 401(k) and then converting them to a Roth 401(k). This can allow you to contribute significantly more than the standard contribution limits, especially if you’re already maxing out your pre-tax or Roth contributions.

5.3. Prioritizing Contributions Based on Age

Adjust your contribution strategy based on your age. Younger individuals with a longer time horizon may focus on maximizing contributions to capture the benefits of compounding returns. Older individuals closer to retirement may prioritize catch-up contributions and risk management.

5.4. Rebalancing Your Portfolio

Regularly rebalance your portfolio to maintain your desired asset allocation. This involves selling assets that have performed well and buying those that have underperformed to bring your portfolio back to its target allocation. This strategy helps manage risk and can improve long-term returns.

5.5. Utilizing a Financial Advisor

Consider working with a financial advisor to develop a personalized retirement plan. A financial advisor can help you assess your financial situation, set realistic goals, and create a strategy to achieve them. They can also provide ongoing guidance and support to help you stay on track. At HOW.EDU.VN we have over 100 renowned PhDs that can help with exactly that.

6. Common Mistakes to Avoid When Contributing to a 401(k)

What are the common pitfalls to avoid when contributing to a 401(k)? Avoiding common mistakes can help you maximize your retirement savings and avoid unnecessary penalties.

6.1. Not Contributing Enough to Get the Full Employer Match

As mentioned earlier, not contributing enough to get the full employer match is a significant mistake. It’s essentially leaving free money on the table.

6.2. Not Reviewing Your Investment Options

Many people set up their 401(k) and never review their investment options. Make sure your investments align with your risk tolerance and time horizon. Consider diversifying your portfolio to reduce risk.

6.3. Taking Early Withdrawals

Taking early withdrawals from your 401(k) can result in significant penalties and taxes. Avoid early withdrawals unless absolutely necessary.

6.4. Not Understanding Fees

Be aware of the fees associated with your 401(k), including administrative fees, investment management fees, and other charges. High fees can significantly reduce your returns over time.

6.5. Neglecting to Update Beneficiaries

Make sure to update your beneficiaries regularly to ensure your assets are distributed according to your wishes.

7. How Economic Factors Influence 401(k) Contributions

How do economic factors like inflation, interest rates, and market volatility affect your 401(k) contributions? Economic conditions can significantly impact your 401(k) contributions and overall retirement savings.

7.1. Inflation

Inflation erodes the purchasing power of your savings. When inflation is high, you may need to increase your contributions to maintain your desired retirement lifestyle.

7.2. Interest Rates

Interest rates affect the returns on fixed-income investments. When interest rates are low, you may need to increase your contributions to achieve your retirement goals.

7.3. Market Volatility

Market volatility can create uncertainty about your retirement savings. During periods of high volatility, it’s essential to stay disciplined and avoid making emotional decisions. Consider dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of market conditions.

7.4. Economic Recessions

During economic recessions, you may face job losses or reduced income. If possible, continue contributing to your 401(k) during these times to take advantage of lower stock prices.

7.5. Government Policies

Government policies, such as tax laws and retirement regulations, can impact your 401(k) contributions and savings. Stay informed about these policies and how they may affect your retirement plan.

8. The Role of Compound Interest in 401(k) Growth

How does compound interest contribute to the long-term growth of your 401(k) investments? Compound interest is a powerful force that can significantly enhance the growth of your 401(k) over time.

8.1. Understanding Compound Interest

Compound interest is the interest you earn not only on your initial investment but also on the accumulated interest from previous periods. It’s like earning interest on your interest, which can lead to exponential growth over time.

8.2. The Power of Time

The longer your money has to grow, the more significant the impact of compound interest. Starting to save early can make a substantial difference in your retirement savings.

8.3. Reinvesting Earnings

Reinvesting your earnings, such as dividends and capital gains, can further accelerate the growth of your 401(k) through compound interest.

8.4. The Impact of Contribution Amount

The more you contribute to your 401(k), the more money you have working for you through compound interest.

8.5. Examples of Compound Interest

Let’s look at an example to illustrate the power of compound interest:

| Scenario | Initial Investment | Annual Contribution | Annual Return | Years | Total Savings |

|---|---|---|---|---|---|

| Starting Early | $5,000 | $5,000 | 7% | 40 | $1,288,869 |

| Starting Late | $5,000 | $5,000 | 7% | 20 | $219,356 |

| Higher Contribution | $5,000 | $10,000 | 7% | 40 | $2,577,738 |

As you can see, starting early and contributing more can significantly increase your retirement savings through the power of compound interest.

9. Estate Planning and 401(k) Accounts

How do 401(k) accounts fit into your overall estate planning strategy? Integrating your 401(k) into your estate plan ensures your assets are distributed according to your wishes and can minimize taxes.

9.1. Naming Beneficiaries

One of the most important aspects of estate planning for your 401(k) is naming beneficiaries. Your beneficiaries will inherit your 401(k) assets upon your death. Make sure to keep your beneficiary designations up to date, especially after major life events such as marriage, divorce, or the birth of a child.

9.2. Spousal Rights

In many cases, your spouse has certain rights regarding your 401(k). For example, your spouse may need to consent to any beneficiary designations that name someone other than them.

9.3. Tax Implications

The tax implications of inheriting a 401(k) can be complex. Non-spouse beneficiaries typically have to pay income taxes on withdrawals from the 401(k). However, a spouse beneficiary has more options, such as rolling the 401(k) into their own retirement account or taking distributions over their lifetime.

9.4. Estate Taxes

Your 401(k) assets may be subject to estate taxes, depending on the size of your estate and applicable tax laws. Working with an estate planning attorney can help you minimize estate taxes and ensure your assets are distributed according to your wishes.

9.5. Reviewing Your Estate Plan

Regularly review your estate plan, including your 401(k) beneficiary designations, to ensure it still meets your needs and goals. Life changes, such as marriage, divorce, or the birth of a child, can impact your estate planning needs.

10. Seeking Professional Advice

When should you seek professional advice regarding your 401(k) contributions and retirement planning? Deciding when to seek professional advice for your 401(k) and retirement planning can make a significant difference in your financial outcomes.

10.1. When to Seek Advice

Consider seeking professional advice in the following situations:

- You’re unsure how much to contribute to your 401(k).

- You’re overwhelmed by the investment options in your 401(k).

- You’re not sure how to allocate your assets.

- You’re approaching retirement and need help developing a retirement income strategy.

- You have complex financial circumstances.

10.2. Types of Professionals

There are several types of professionals who can provide advice on 401(k)s and retirement planning, including:

- Financial advisors

- Certified Financial Planners (CFPs)

- Retirement planners

- Tax advisors

- Estate planning attorneys

10.3. How to Choose a Professional

When choosing a professional, consider the following factors:

- Qualifications and experience

- Fees and compensation structure

- Services offered

- Client testimonials and references

- Personal compatibility

10.4. Questions to Ask

Before hiring a professional, ask the following questions:

- What are your qualifications and experience?

- What are your fees and how are you compensated?

- What services do you offer?

- What is your investment philosophy?

- Can you provide client testimonials or references?

10.5. Benefits of Professional Advice

The benefits of seeking professional advice include:

- Personalized guidance

- Objective advice

- Expert knowledge

- Time savings

- Improved financial outcomes

By carefully considering these factors and seeking professional advice when needed, you can optimize your 401(k) contributions and achieve your retirement goals.

Knowing how much should you contribute to 401k is a vital step toward securing your financial future. By understanding contribution limits, employer matching, and your personal financial situation, you can make informed decisions to optimize your retirement savings. Remember, the team of over 100 renowned PhDs at HOW.EDU.VN is here to guide you every step of the way.

Don’t let financial complexities hold you back. Contact HOW.EDU.VN today for personalized advice and expert guidance from our team of over 100 renowned PhDs. Whether you need help understanding contribution limits, maximizing employer matching, or developing a comprehensive retirement plan, our experts are here to help you achieve your financial goals. Visit our website how.edu.vn, call us at +1 (310) 555-1212, or visit us at 456 Expertise Plaza, Consult City, CA 90210, United States. Let us help you build a secure and prosperous future.

FAQ: 401(k) Contributions

Here are some frequently asked questions about 401(k) contributions:

Q1: What is a 401(k)?

A 401(k) is a retirement savings plan sponsored by an employer. It allows employees to save and invest a portion of their paycheck before taxes.

Q2: How much can I contribute to my 401(k) in 2025?

For 2025, individuals can contribute up to $23,500. If you’re 50 or older, you can contribute an additional $7,500, totaling $31,000. Those aged 60-63 can contribute an extra $11,250, for a total of $34,750.

Q3: What is employer matching?

Employer matching is when your employer contributes to your 401(k) based on your contributions. This is typically a percentage of your contributions up to a certain limit.

Q4: How do I maximize employer matching?

To maximize employer matching, contribute at least enough to get the full match. This is essentially free money that can significantly boost your retirement savings.

Q5: What is vesting?

Vesting is the process of earning full ownership of your employer’s contributions to your 401(k). Vesting schedules vary, but common types include immediate vesting, cliff vesting, and graded vesting.

Q6: What is the difference between a Roth 401(k) and a traditional 401(k)?

Traditional 401(k) contributions are made pre-tax, reducing your current taxable income, but you’ll pay taxes on withdrawals in retirement. Roth 401(k) contributions are made after-tax, so you won’t pay taxes on withdrawals in retirement.

Q7: What happens if I contribute too much to my 401(k)?

Contributing above the IRS-allowable amount can result in double taxation. You’ll need to withdraw the excess amount and any earnings to avoid penalties.

Q8: Can I withdraw money from my 401(k) before retirement?

You can withdraw money from your 401(k) before retirement, but you may face penalties and taxes. It’s generally best to avoid early withdrawals unless absolutely necessary.

Q9: How do I choose investments for my 401(k)?

Consider your risk tolerance, time horizon, and financial goals when choosing investments for your 401(k). Diversifying your portfolio can help reduce risk.

Q10: Should I seek professional advice for my 401(k)?

Seeking professional advice can be beneficial if you’re unsure how much to contribute, overwhelmed by investment options, or need help developing a retirement income strategy.