How Much Should You Contribute To Your 401k? Determining the optimal 401k contribution involves understanding contribution limits, potential employer matching, and aligning your savings with personal financial goals, securing your financial future. For expert guidance tailored to your unique circumstances, consult the experienced PhDs at HOW.EDU.VN for personalized advice on retirement planning and wealth accumulation strategies. Optimize your retirement savings and achieve financial security by exploring strategies for maximizing returns and managing risk.

1. Understanding 401(k) Contribution Limits

The IRS sets annual contribution limits to 401(k) plans, impacting how much you can save tax-advantaged for retirement. Staying informed about these limits is crucial for effective retirement planning.

1.1. Annual Contribution Limits

For 2025, the IRS sets the 402(g) limit at $23,500 for individual contributions to traditional and Roth 401(k) accounts. This limit applies to all individuals, regardless of age, until they reach 50.

Individuals aged 50 and over can make an additional “catch-up” contribution. The total contribution limit, including the catch-up contribution, is $31,000 for 2025.

Beginning in 2025, those aged 60-63 can contribute $11,250 extra, for a total of $34,750. These limits are subject to annual review and adjustments by the IRS to account for cost-of-living changes.

1.2. Employer Contributions

The IRS also sets limits on the total amount that can be contributed to a 401(k) account, including both employee and employer contributions. This is known as the 415(c) limit.

For 2025, the 415(c) limit is $70,000. This limit includes all contributions to your 401(k) account, including your own paycheck deferrals, employer matching contributions, and any profit sharing contributions.

If you are 50 or older, this limit increases to $77,500 and if you’re 60-63, it’s $81,250.

Your total 401(k) contributions cannot exceed 100% of your taxable income. The IRS typically reevaluates the 415(c) limit annually, often increasing it in line with the 402(g) limit.

1.3. Multiple 401(k) Plans

If you participate in more than one 401(k) plan during the year, the individual deferral limits still apply across all plans. This means the 402(g) limit is a cumulative limit, not a per-plan limit.

If you change jobs during the year and enroll in a new employer’s 401(k) plan, you need to consider any contributions you’ve already made to your previous employer’s plan.

Inform your new 401(k) provider about your year-to-date contributions to avoid exceeding the annual limit. Over-contributing can lead to tax complications and penalties.

1.4. Rollovers and Contribution Limits

Rolling over funds from a previous 401(k) or other retirement account generally does not affect your annual contribution limit. Rollovers are not considered new contributions but rather a transfer of existing funds.

However, if you roll over after-tax contributions from a previous plan, the rollover may impact your ability to make future after-tax contributions to your current plan, depending on the plan’s rules. It’s important to understand the tax implications of rollovers, especially when dealing with after-tax funds.

1.5. Consequences of Exceeding Contribution Limits

Contributing more than the IRS-allowed amount can lead to adverse tax consequences. The excess contributions are not tax-deferred and may be taxed twice: once when contributed and again when withdrawn in retirement.

The IRS may also impose penalties on excess contributions if they are not corrected in a timely manner. To avoid these consequences, it is crucial to monitor your contributions throughout the year and ensure that you do not exceed the annual limits.

1.6. Seeking Expert Guidance

Navigating the complexities of 401(k) contribution limits can be challenging. Consulting with a qualified financial advisor can provide personalized guidance based on your individual circumstances and financial goals.

At HOW.EDU.VN, our team of experienced PhDs offers expert advice on retirement planning, including strategies for maximizing your 401(k) contributions while staying within IRS limits. Contact us today to schedule a consultation and ensure a secure financial future.

2. Maximizing Employer Matching Contributions

Employer matching contributions are a valuable benefit that can significantly boost your retirement savings. Understanding how your employer’s matching program works and maximizing your contributions to take full advantage of it is essential.

2.1. Understanding Employer Matching Formulas

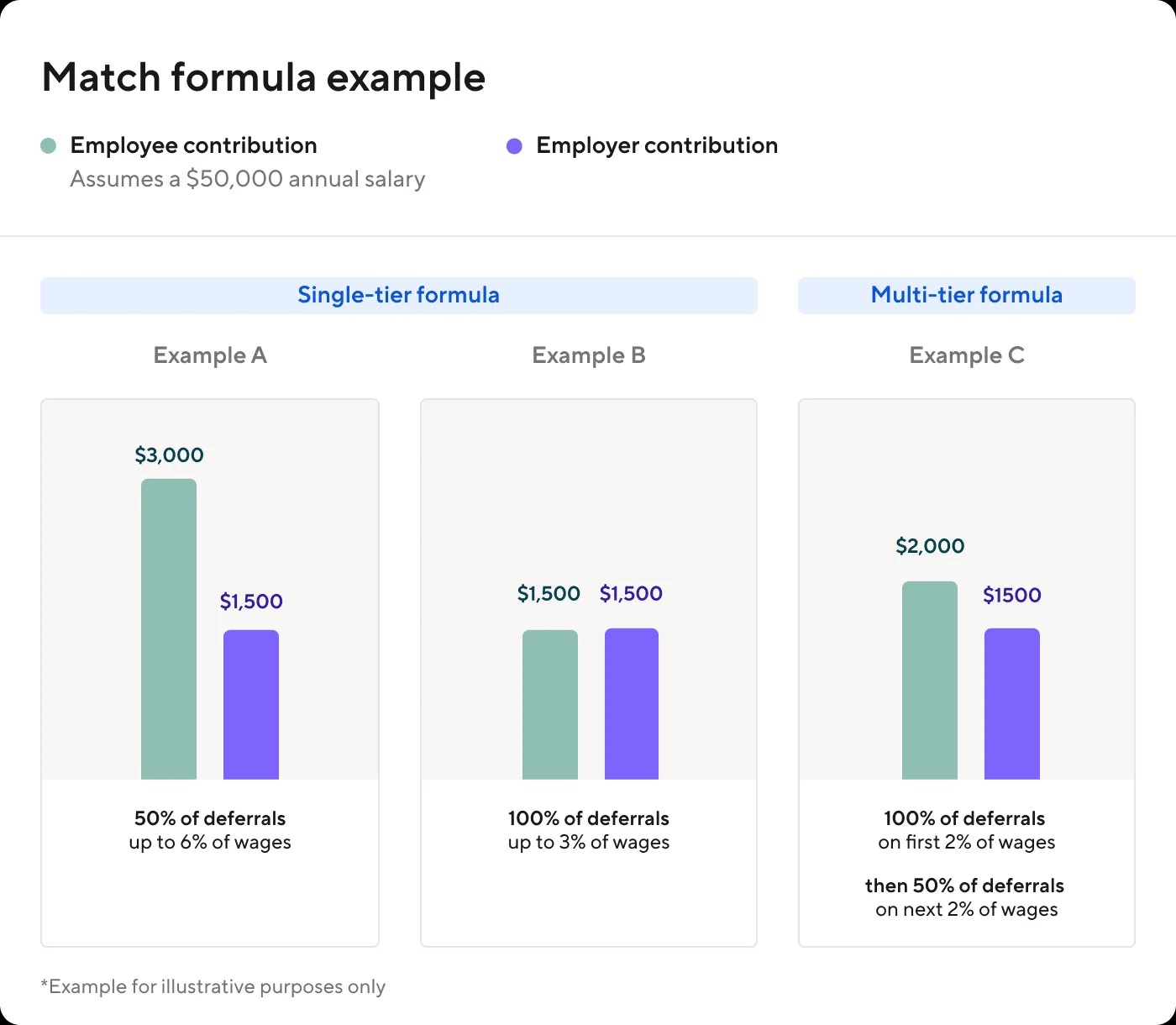

Employers offer various matching formulas, which determine how much they will contribute to your 401(k) based on your own contributions. Common matching formulas include:

- Single-Tier Formula: The employer matches a fixed percentage of your contributions up to a certain percentage of your salary. For example, the employer may match 50% of your contributions up to 6% of your salary.

- Multi-Tier Formula: The employer matches different percentages of your contributions at different tiers. For example, the employer may match 100% of your contributions up to 3% of your salary and then match 50% of the next 2% of your salary.

Understanding your employer’s matching formula is crucial for determining how much you need to contribute to receive the maximum match.

2.2. Calculating the Maximum Match

To calculate the maximum match you can receive, determine the percentage of your salary that you need to contribute to receive the full match. For example, if your employer matches 50% of your contributions up to 6% of your salary, you need to contribute at least 6% of your salary to receive the maximum match.

If your salary is $50,000, contributing 6% would mean contributing $3,000 per year. The employer would then match 50% of this amount, contributing an additional $1,500 to your 401(k).

2.3. The Importance of Meeting the Match

Failing to contribute enough to meet your employer’s match is essentially leaving money on the table. Employer matching contributions are like a guaranteed return on your investment.

Not meeting your match can significantly impact your retirement savings over time. Even a seemingly small match can add up to a substantial amount due to the power of compounding.

2.4. Contributing Beyond the Match

Once you are contributing enough to receive the maximum employer match, consider contributing even more to your 401(k) if your budget allows. Contributing beyond the match can help you reach your retirement goals faster and take greater advantage of the tax benefits of a 401(k) plan.

While contributing beyond the match will not result in additional employer contributions, it can significantly increase your own savings and help you build a larger retirement nest egg.

2.5. Vesting Schedules

Vesting refers to when you have full ownership of your employer’s matching contributions. Some employers have vesting schedules, which determine how long you need to work for the company before you are fully vested in the employer’s contributions.

Common vesting schedules include:

- Immediate Vesting: You are immediately 100% vested in your employer’s contributions.

- Cliff Vesting: You become 100% vested after a certain period of time, such as two or three years.

- Graded Vesting: You gradually become vested over a period of time, such as 20% per year.

Understanding your employer’s vesting schedule is important because if you leave the company before you are fully vested, you may forfeit some or all of the employer’s matching contributions.

2.6. Seeking Professional Advice

Maximizing your employer matching contributions is a key component of a successful retirement savings strategy. If you are unsure how to best take advantage of your employer’s matching program, seek advice from a qualified financial advisor.

HOW.EDU.VN offers expert guidance on retirement planning, including strategies for maximizing employer matching contributions and achieving your financial goals. Contact us today to schedule a consultation with one of our experienced PhDs.

3. Factors to Consider When Determining Your Contribution Rate

Determining the right 401(k) contribution rate involves evaluating various factors to align with your financial situation and retirement goals. It is a personal decision that should take into account your current income, expenses, debt, and long-term objectives.

3.1. Current Income and Expenses

Assess your current income and expenses to determine how much you can realistically afford to contribute to your 401(k). Create a budget that outlines your monthly income, fixed expenses, and discretionary spending.

Identify areas where you can potentially cut back on expenses to free up more money for retirement savings. Even small reductions in spending can add up to significant savings over time.

3.2. Debt Obligations

Evaluate your debt obligations, including student loans, credit card debt, and mortgages. High-interest debt can significantly impact your ability to save for retirement.

Consider prioritizing paying down high-interest debt before increasing your 401(k) contributions. Reducing your debt burden can free up more cash flow and improve your overall financial health.

3.3. Retirement Goals

Define your retirement goals to estimate how much you will need to save to maintain your desired lifestyle in retirement. Consider factors such as your expected retirement age, desired income level, and potential healthcare costs.

Use online retirement calculators or consult with a financial advisor to project your retirement savings needs. This will help you determine a target contribution rate that aligns with your goals.

3.4. Age and Time Horizon

Your age and time horizon until retirement significantly impact your 401(k) contribution strategy. Younger individuals with a longer time horizon have the advantage of compounding returns, while older individuals may need to save more aggressively to catch up.

If you are starting to save for retirement later in life, consider increasing your contribution rate to the maximum allowable amount, especially if you are eligible for catch-up contributions.

3.5. Risk Tolerance

Consider your risk tolerance when determining your 401(k) investment strategy. Younger investors with a longer time horizon may be able to tolerate more risk, while older investors may prefer a more conservative approach.

Diversify your 401(k) investments across different asset classes, such as stocks, bonds, and real estate, to manage risk and potentially enhance returns.

3.6. Tax Implications

Understand the tax implications of contributing to a 401(k) plan. Traditional 401(k) contributions are tax-deductible, reducing your current taxable income. Roth 401(k) contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free.

Consider your current and future tax bracket when deciding between traditional and Roth 401(k) contributions. Consult with a tax advisor to determine the most tax-efficient strategy for your situation.

3.7. Financial Priorities

Balance your retirement savings goals with other financial priorities, such as buying a home, saving for your children’s education, or starting a business. Prioritize your financial goals based on your individual circumstances and values.

Consider setting up separate savings accounts for different financial goals to avoid dipping into your retirement savings.

3.8. Seeking Personalized Advice

Determining the right 401(k) contribution rate is a complex decision that requires careful consideration of your individual circumstances and financial goals. Seeking personalized advice from a qualified financial advisor can help you develop a customized retirement savings strategy.

At HOW.EDU.VN, our team of experienced PhDs offers expert guidance on retirement planning, including strategies for determining the optimal 401(k) contribution rate and achieving your financial goals. Contact us today to schedule a consultation and take control of your financial future.

4. Strategies for Increasing Your 401(k) Contributions

Increasing your 401(k) contributions can significantly boost your retirement savings and help you reach your financial goals faster. Even small incremental increases can have a substantial impact over time, thanks to the power of compounding.

4.1. Start Small and Increase Gradually

If you are unable to contribute a large percentage of your income to your 401(k) right away, start with a smaller contribution rate and increase it gradually over time. Even a 1% or 2% increase in your contribution rate can make a difference.

Set a goal to increase your contribution rate by a certain amount each year, such as when you receive a raise or bonus. This will help you stay on track towards your retirement savings goals.

4.2. Take Advantage of Employer Matching

Ensure that you are contributing enough to your 401(k) to receive the maximum employer match. Not doing so is essentially leaving free money on the table.

If you are not currently contributing enough to receive the full match, increase your contribution rate until you are. This is one of the easiest and most effective ways to boost your retirement savings.

4.3. Automate Your Contributions

Set up automatic 401(k) contributions through your employer’s payroll system. This will ensure that your contributions are made consistently and without you having to think about it.

Automating your contributions can help you stay disciplined with your retirement savings and avoid the temptation to skip contributions when money is tight.

4.4. Reduce Discretionary Spending

Identify areas where you can reduce discretionary spending to free up more money for retirement savings. Small changes in your spending habits can add up to significant savings over time.

Consider cutting back on non-essential expenses, such as eating out, entertainment, and shopping, to increase your 401(k) contributions.

4.5. Increase Contributions with Raises and Bonuses

Whenever you receive a raise or bonus, consider increasing your 401(k) contribution rate. This is an easy way to boost your retirement savings without significantly impacting your current lifestyle.

Set aside a portion of your raise or bonus specifically for retirement savings. This will help you stay on track towards your financial goals.

4.6. Consider a Roth 401(k)

If your employer offers a Roth 401(k) option, consider contributing to it instead of a traditional 401(k). Roth 401(k) contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free.

This can be a particularly attractive option if you expect to be in a higher tax bracket in retirement than you are currently.

4.7. Rebalance Your Portfolio

Periodically rebalance your 401(k) portfolio to ensure that it aligns with your risk tolerance and investment goals. Rebalancing involves selling some assets and buying others to maintain your desired asset allocation.

Rebalancing can help you manage risk and potentially enhance returns over the long term.

4.8. Seek Professional Guidance

Increasing your 401(k) contributions is a crucial step towards achieving your retirement goals. If you are unsure how to best increase your contributions, seek advice from a qualified financial advisor.

HOW.EDU.VN offers expert guidance on retirement planning, including strategies for increasing your 401(k) contributions and achieving your financial goals. Contact us today to schedule a consultation with one of our experienced PhDs.

5. Common Mistakes to Avoid When Contributing to a 401(k)

Contributing to a 401(k) is a smart way to save for retirement, but it’s essential to avoid common mistakes that can derail your progress. Understanding these pitfalls can help you make informed decisions and maximize your retirement savings.

5.1. Not Contributing Enough to Get the Employer Match

One of the biggest mistakes you can make is not contributing enough to your 401(k) to receive the full employer match. This is essentially leaving free money on the table.

Make sure you understand your employer’s matching formula and contribute enough to take full advantage of it.

5.2. Maxing Out Too Early in the Year

While contributing enough to get the employer match is essential, maxing out your 401(k) contributions too early in the year can also be a mistake. If you max out your contributions before the end of the year, you may miss out on a portion of the employer match.

Adjust your contribution rate so that you contribute consistently throughout the year and receive the full employer match.

5.3. Not Diversifying Your Investments

Failing to diversify your 401(k) investments can increase your risk and potentially reduce your returns. Diversification involves spreading your investments across different asset classes, such as stocks, bonds, and real estate.

Make sure your 401(k) portfolio is well-diversified to manage risk and potentially enhance returns over the long term.

5.4. Borrowing From Your 401(k)

Borrowing from your 401(k) can have serious consequences for your retirement savings. When you borrow from your 401(k), you are essentially taking money out of your retirement account and delaying your savings progress.

Avoid borrowing from your 401(k) unless it is absolutely necessary. Consider other options, such as a personal loan or line of credit, before tapping into your retirement savings.

5.5. Cashing Out Your 401(k) Early

Cashing out your 401(k) early can result in significant penalties and taxes. In addition to the tax consequences, you will also lose the potential for future growth on those savings.

Avoid cashing out your 401(k) early unless it is absolutely necessary. Consider other options, such as rolling over your 401(k) to an IRA or another qualified retirement plan.

5.6. Not Rebalancing Your Portfolio

Failing to rebalance your 401(k) portfolio can lead to an asset allocation that is not aligned with your risk tolerance and investment goals. Over time, your portfolio may become overweighted in certain asset classes and underweighted in others.

Periodically rebalance your 401(k) portfolio to maintain your desired asset allocation and manage risk.

5.7. Ignoring Fees

Paying attention to the fees associated with your 401(k) plan can help you save money and improve your returns. Fees can eat into your retirement savings over time, so it’s essential to understand what you are paying and whether the fees are reasonable.

Consider switching to a lower-cost 401(k) plan if your current plan has high fees.

5.8. Seeking Expert Guidance

Avoiding common 401(k) mistakes is crucial for maximizing your retirement savings and achieving your financial goals. If you are unsure how to avoid these pitfalls, seek advice from a qualified financial advisor.

HOW.EDU.VN offers expert guidance on retirement planning, including strategies for avoiding common 401(k) mistakes and achieving your financial goals. Contact us today to schedule a consultation with one of our experienced PhDs.

6. The Long-Term Impact of Consistent 401(k) Contributions

Consistent 401(k) contributions, even if they seem small at first, can have a profound impact on your long-term financial security. The power of compounding, combined with the tax advantages of a 401(k), can help you build a substantial retirement nest egg over time.

6.1. The Power of Compounding

Compounding is the process of earning returns on your initial investment and then earning returns on those returns. Over time, compounding can significantly increase your retirement savings.

The earlier you start contributing to your 401(k), the more time your investments have to grow through compounding.

6.2. Tax Advantages

401(k) plans offer significant tax advantages that can boost your retirement savings. Traditional 401(k) contributions are tax-deductible, reducing your current taxable income. Roth 401(k) contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free.

These tax advantages can help you save more money for retirement and reduce your overall tax burden.

6.3. Building a Substantial Retirement Nest Egg

Consistent 401(k) contributions, combined with the power of compounding and tax advantages, can help you build a substantial retirement nest egg over time. Even small contributions made consistently over many years can add up to a significant amount.

The more you contribute to your 401(k, the more you will have available to fund your retirement years.

6.4. Achieving Financial Security

Building a substantial retirement nest egg through consistent 401(k) contributions can help you achieve financial security in retirement. With enough savings, you can maintain your desired lifestyle and enjoy your retirement years without financial stress.

Retirement can be a time of freedom and opportunity, but it’s essential to have enough savings to support your needs and goals.

6.5. Leaving a Legacy

In addition to providing for your own retirement, consistent 401(k) contributions can also help you leave a legacy for your loved ones. With careful planning, you can pass on your retirement savings to your heirs and help them achieve their financial goals.

Leaving a legacy can be a meaningful way to give back to your family and community.

6.6. Seeking Professional Guidance

Understanding the long-term impact of consistent 401(k) contributions is essential for achieving your retirement goals. If you are unsure how to best plan for your retirement, seek advice from a qualified financial advisor.

HOW.EDU.VN offers expert guidance on retirement planning, including strategies for maximizing the long-term impact of your 401(k) contributions and achieving your financial goals. Contact us today to schedule a consultation with one of our experienced PhDs.

Man using calculator to determine 401k contributions

Man using calculator to determine 401k contributions

7. Expert Insights from HOW.EDU.VN on Retirement Planning

At HOW.EDU.VN, we understand the importance of planning for a secure retirement. Our team of experienced PhDs is dedicated to providing expert insights and guidance to help you achieve your financial goals.

7.1. Personalized Retirement Planning Strategies

We offer personalized retirement planning strategies tailored to your individual circumstances and financial goals. Our experts will work with you to assess your current financial situation, define your retirement goals, and develop a customized plan to help you achieve them.

Our personalized retirement planning strategies take into account your income, expenses, debt, risk tolerance, and time horizon.

7.2. Maximizing Your 401(k) Contributions

We provide guidance on maximizing your 401(k) contributions to take full advantage of the tax benefits and employer matching opportunities. Our experts will help you determine the right contribution rate to align with your financial goals.

We also offer advice on how to diversify your 401(k) investments to manage risk and potentially enhance returns.

7.3. Avoiding Common Retirement Planning Mistakes

We help you avoid common retirement planning mistakes that can derail your progress. Our experts will guide you on how to make informed decisions about your retirement savings and investments.

We provide advice on how to manage your debt, reduce your expenses, and avoid cashing out your retirement savings early.

7.4. Achieving Financial Security in Retirement

We are committed to helping you achieve financial security in retirement. Our experts will provide you with the knowledge and tools you need to build a substantial retirement nest egg and enjoy your retirement years without financial stress.

We offer guidance on how to plan for your healthcare expenses, long-term care needs, and other retirement-related costs.

7.5. Expert Guidance and Support

At HOW.EDU.VN, we provide expert guidance and support throughout your retirement planning journey. Our team of experienced PhDs is available to answer your questions, address your concerns, and provide ongoing advice and support.

We are dedicated to helping you achieve your financial goals and enjoy a secure and fulfilling retirement.

7.6. Contact Us Today

If you are ready to take control of your retirement planning and achieve your financial goals, contact us today to schedule a consultation with one of our experienced PhDs. We are here to help you plan for a secure and fulfilling retirement.

Visit our website at HOW.EDU.VN or call us at +1 (310) 555-1212 to learn more about our services and schedule a consultation. Our office is located at 456 Expertise Plaza, Consult City, CA 90210, United States.

8. Case Studies: Successful Retirement Planning with 401(k) Contributions

These case studies illustrate how different individuals have successfully utilized 401(k) contributions as part of their retirement planning strategies. While these scenarios are fictionalized, they are based on common financial situations and principles.

8.1. Case Study 1: The Young Professional

Background: Sarah is a 28-year-old marketing professional earning $60,000 per year. She started contributing to her company’s 401(k) plan at age 25, contributing 6% of her salary to receive the full employer match of 3%.

Strategy: Sarah increased her contribution rate by 1% each year. She diversified her investments across a mix of stocks and bonds.

Results: By age 65, Sarah accumulated a substantial retirement nest egg, allowing her to retire comfortably and pursue her passions.

8.2. Case Study 2: The Mid-Career Saver

Background: John is a 45-year-old engineer earning $100,000 per year. He started saving for retirement later in life, contributing 10% of his salary to his company’s 401(k) plan.

Strategy: John took advantage of catch-up contributions once he turned 50. He worked closely with a financial advisor to develop a comprehensive retirement plan.

Results: By age 65, John had accumulated enough savings to retire comfortably and maintain his desired lifestyle.

8.3. Case Study 3: The Business Owner

Background: Maria is a 55-year-old business owner earning $150,000 per year. She established a solo 401(k) plan for herself, contributing the maximum allowable amount each year.

Strategy: Maria took advantage of both employee and employer contributions to maximize her savings. She worked with a tax advisor to optimize her retirement plan for tax efficiency.

Results: By age 65, Maria had accumulated a substantial retirement nest egg, allowing her to sell her business and retire comfortably.

8.4. Key Takeaways from the Case Studies

These case studies demonstrate the importance of starting early, contributing consistently, and seeking professional guidance. By following these principles, you can increase your chances of achieving your retirement goals.

These individuals come from varying backgrounds and income levels, but each has been able to retire comfortably.

It shows that a solid plan and consistent contributions towards a 401k can provide financial security in retirement.

9. Frequently Asked Questions (FAQ) About 401(k) Contributions

Here are some frequently asked questions about 401(k) contributions to help you make informed decisions about your retirement savings:

-

Q: How much should I contribute to my 401(k)?

- A: The amount you should contribute to your 401(k) depends on your individual circumstances and financial goals. As a general rule, try to contribute at least enough to receive the full employer match.

-

Q: What is the maximum amount I can contribute to my 401(k) in 2025?

- A: For 2025, the maximum individual contribution limit is $23,500. If you are 50 or older, you can contribute an additional $7,500 for a total of $31,000. If you are 60-63, you can contribute an additional $11,250 for a total of $34,750.

-

Q: What is employer matching?

- A: Employer matching is when your employer contributes to your 401(k) based on your own contributions. The matching formula can vary, but it is typically a percentage of your salary.

-

Q: What is vesting?

- A: Vesting refers to when you have full ownership of your employer’s matching contributions. Some employers have vesting schedules, which determine how long you need to work for the company before you are fully vested.

-

Q: What is a Roth 401(k)?

- A: A Roth 401(k) is a type of 401(k) where contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free.

-

Q: What happens if I contribute too much to my 401(k)?

- A: If you contribute too much to your 401(k), you may be subject to penalties and taxes. It’s important to monitor your contributions and make sure you don’t exceed the annual limits.

-

Q: Can I borrow from my 401(k)?

- A: Yes, you can borrow from your 401(k), but it’s generally not recommended. Borrowing from your 401(k) can have serious consequences for your retirement savings.

-

Q: What should I invest in my 401(k)?

- A: The investments you should choose for your 401(k) depend on your risk tolerance and time horizon. As a general rule, diversify your investments across a mix of stocks, bonds, and other asset classes.

-

Q: How often should I rebalance my 401(k) portfolio?

- A: You should rebalance your 401(k) portfolio periodically, typically once a year or whenever your asset allocation deviates significantly from your desired allocation.

-

Q: Where can I get help with my 401(k) contributions and retirement planning?

- A: You can get help with your 401(k) contributions and retirement planning from a qualified financial advisor. HOW.EDU.VN offers expert guidance on retirement planning. Contact us today to schedule a consultation with one of our experienced PhDs.

10. Take Control of Your Retirement Savings Today with HOW.EDU.VN

Planning for retirement can be a daunting task, but with the right guidance and strategies, you can achieve your financial goals and enjoy a secure and fulfilling retirement. At HOW.EDU.VN, we are committed to providing you with the expert insights and support you need to succeed.

10.1. Connect with Our Team of Experienced PhDs

Our team of experienced PhDs specializes in retirement planning and wealth management. We offer personalized advice and strategies tailored to your individual circumstances and financial goals.

Contact us today to schedule a consultation and learn how we can help you take control of your retirement savings.

10.2. Personalized Retirement Planning Solutions

We offer a range of personalized retirement planning solutions, including:

- 401(k) contribution strategies

- Investment management

- Retirement income planning

- Tax optimization

Our solutions are designed to help you maximize your retirement savings and achieve your financial goals.

10.3. Expert Guidance and Support

We provide expert guidance and support throughout your retirement planning journey. Our team is available to answer your questions, address your concerns, and provide ongoing advice and support.

We are committed to helping you achieve your financial goals and enjoy a secure and fulfilling retirement.

10.4. Contact Us Today

Don’t wait to start planning for your retirement. Contact us today to schedule a consultation with one of our experienced PhDs. We are here to help you plan for a secure and fulfilling retirement.

Visit our website at HOW.EDU.VN or call us at +1 (310) 555-1212 to learn more about our services and schedule a consultation. Our office is located at 456 Expertise Plaza, Consult City, CA 90210, United States. Let how.edu.vn guide you towards a financially secure retirement.