How Much Was One Shilling Worth in the past? Delve into the intriguing world of pre-decimalisation British currency with HOW.EDU.VN, exploring its historical context and purchasing power, and gaining insight into its value relative to today’s money. Uncover the intricacies of the shilling and its connection to British financial heritage with the help of expert historical analysis and financial perspective, enhancing your understanding of historical economics.

1. Understanding the Historical Context of the Shilling

The shilling, a unit of currency steeped in British history, offers a fascinating glimpse into the economic landscape of bygone eras. To truly appreciate its worth, it’s crucial to understand the historical context in which it existed. This section will explore the origins of the shilling, its evolution over time, and its significance within the broader framework of British currency.

1.1. Origins and Evolution of the Shilling

The term “shilling” has its roots in the Old English word “scilling,” which referred to a coin or a unit of account. Its usage can be traced back to Anglo-Saxon times, long before the Norman Conquest. Over the centuries, the shilling’s value and composition underwent numerous transformations, reflecting the changing economic and political conditions of Britain.

Initially, the shilling was not a physical coin but rather a unit of account, representing a specific weight of silver. As coinage became more standardized, the shilling eventually materialized as a silver coin, playing a vital role in everyday transactions. Its value fluctuated depending on the reigning monarch, the purity of the silver, and the economic climate of the time.

1.2. The Shilling in the Pre-Decimalisation Era

Before the decimalisation of British currency in 1971, the monetary system was notoriously complex. The basic unit was the pound sterling (£), which was divided into 20 shillings (s) and each shilling into 12 pence (d). This LSD system ( Librae, Solidi, Denarii ) was inherited from the Romans and had been in use for centuries.

The shilling, therefore, occupied a crucial middle ground in this system. It was a convenient denomination for many everyday transactions, representing a significant but not prohibitive sum of money. Its value was widely understood and accepted, making it an integral part of British commerce.

1.3. The Shilling and the British Empire

The British Empire’s vast reach extended the shilling’s influence far beyond the shores of Britain. As a currency recognized and accepted throughout the empire, the shilling facilitated trade and commerce in far-flung corners of the world.

From Canada to Australia, from India to South Africa, the shilling played a role in the economic lives of millions. Its presence in these territories served as a tangible link to the mother country, reinforcing Britain’s economic and political dominance. The legacy of the shilling can still be seen in the currencies of some former British colonies, which retain denominations reminiscent of the pre-decimalisation system.

2. Deconstructing the Value of a Shilling

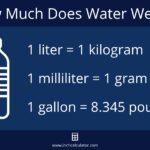

To understand how much was one shilling worth, we need to deconstruct its value in terms of its relationship to other denominations within the pre-decimalisation system and its real-world purchasing power. This section will break down the shilling’s value in relation to pounds, pence, and other coins, and examine what goods and services could be obtained with a shilling in different historical periods.

2.1. The Shilling’s Place in the Pre-Decimal System

In the pre-decimal system, the shilling was intrinsically linked to other denominations:

- 1 Pound (£) = 20 Shillings (s)

- 1 Shilling (s) = 12 Pence (d)

This meant that a pound was a relatively large sum, primarily used for significant transactions, while a penny was suitable for the smallest purchases. The shilling filled the gap in between, providing a convenient medium for everyday commerce.

Other coins in circulation included:

- Half-Crown (2s 6d): Two shillings and sixpence

- Florin (2s): Two shillings

- Sixpence (6d): Half a shilling

- Threepence (3d): A quarter of a shilling

The existence of these various denominations allowed for precise transactions, but also added to the complexity of the system for those unfamiliar with it.

2.2. What Could You Buy with a Shilling?

The purchasing power of a shilling varied considerably over time, depending on factors such as inflation, economic conditions, and availability of goods. However, examining specific historical periods can provide a general sense of its worth.

In the early 20th century, a shilling could buy:

- A loaf of bread

- A pint of beer

- A ticket to the cinema

- A substantial meal at a working-class restaurant

During World War II, rationing and price controls affected the availability and cost of goods. A shilling might have bought a smaller portion of food or been used to purchase rationed items.

2.3. Converting the Shilling’s Value to Today’s Money

Converting the value of a shilling to today’s money is challenging due to the complex interplay of inflation, currency fluctuations, and changes in the cost of living. However, several methods can be used to estimate its approximate worth.

One approach is to use historical inflation calculators, which take into account the changing value of money over time. These calculators can provide a rough estimate of what a shilling in a particular year would be worth today.

Another method is to compare the prices of specific goods and services that were available both then and now. For example, if a loaf of bread cost a shilling in 1930 and now costs £2, this suggests that a shilling in 1930 had the purchasing power of £2 today.

It’s important to note that these conversions are only estimates and should be treated with caution. The true value of a shilling lies not just in its equivalent monetary value today but also in its historical and cultural significance.

3. The Shilling in Popular Culture and Everyday Life

Beyond its economic role, the shilling also held a prominent place in British popular culture and everyday life. It featured in idioms, songs, literature, and common expressions, reflecting its familiarity and importance to the British people.

3.1. Shilling Idioms and Expressions

Several idioms and expressions incorporated the word “shilling,” demonstrating its ingrained presence in the English language:

- “To cut someone off with a shilling”: To disinherit someone, leaving them only a token amount of money.

- “A bob”: A slang term for a shilling.

- “Spend a penny”: A euphemism for using a public toilet, which typically cost a penny.

These expressions reveal how the shilling was woven into the fabric of British communication and social interactions.

3.2. The Shilling in Literature and Music

The shilling also made appearances in literature and music, often serving as a symbol of wealth, poverty, or everyday life.

In Charles Dickens’ novels, shillings are frequently mentioned in the context of characters’ incomes, expenses, and financial struggles. Songs and poems from the era also referenced the shilling, often in a nostalgic or romantic way.

3.3. The Shilling and Social Class

The shilling’s value was not uniform across all social classes. For the wealthy, a shilling might have been a trivial sum, easily spent on a small luxury. But for the working class, a shilling could represent a significant portion of their daily income, carefully budgeted and spent on essential necessities.

The shilling, therefore, served as a marker of social class, highlighting the economic disparities that existed in British society. Its value was relative to the individual’s circumstances and purchasing power.

4. The End of an Era: Decimalisation and the Shilling’s Demise

In 1971, Britain underwent a momentous change with the adoption of decimal currency. This marked the end of the traditional LSD system and the demise of the shilling as a circulating coin. This section will explore the reasons behind decimalisation, the transition process, and the legacy of the shilling in the post-decimal era.

4.1. Reasons for Decimalisation

The decision to decimalise British currency was driven by several factors:

- Simplification: The pre-decimal system was complex and cumbersome, making calculations difficult and time-consuming.

- Efficiency: Decimalisation was expected to improve efficiency in commerce and reduce the risk of errors.

- International Alignment: Most other major economies had already adopted decimal currency, and Britain was seen as being out of step.

The move towards decimalisation was debated for decades before finally being implemented in 1971.

4.2. The Transition Process

The transition to decimal currency was a major undertaking, requiring extensive planning, public education, and logistical coordination. Decimal Day was set for February 15, 1971, and a massive campaign was launched to familiarize the public with the new system.

The new currency was based on the pound (£), which was divided into 100 new pence (p). The shilling was effectively replaced by the five-new-pence coin (5p), which had the same value.

4.3. The Shilling’s Legacy

Although the shilling no longer circulates, its legacy lives on in various ways:

- Nostalgia: For many older Britons, the shilling evokes a sense of nostalgia and a connection to the past.

- Collectibles: Old shillings are now sought-after collectibles, valued for their historical significance and aesthetic appeal.

- Language: The term “shilling” continues to be used in some idioms and expressions, preserving its presence in the English language.

The shilling, therefore, remains a potent symbol of Britain’s rich monetary history, even in the decimal era.

5. How to Find Expert Financial Consultation

Understanding historical currency like the shilling can offer valuable insights into economic principles. However, when facing contemporary financial challenges, seeking expert consultation is crucial. HOW.EDU.VN connects you with leading financial experts who can provide tailored advice.

5.1. The Importance of Expert Financial Advice

Navigating the complexities of modern finance requires expertise and a deep understanding of market trends, investment strategies, and risk management. Whether you’re planning for retirement, managing your investments, or seeking advice on debt management, consulting with a financial expert can make a significant difference.

Financial experts can provide:

- Personalized guidance: Tailored advice based on your individual financial situation and goals.

- Objective analysis: Unbiased assessments of your financial strengths and weaknesses.

- Strategic planning: Development of comprehensive financial plans to achieve your objectives.

- Risk management: Strategies to mitigate financial risks and protect your assets.

5.2. Connecting with Financial Experts at HOW.EDU.VN

HOW.EDU.VN offers a platform to connect with a diverse range of financial experts, each with their own areas of specialization. Whether you’re looking for advice on investment, retirement planning, tax optimization, or debt management, you can find an expert who meets your needs.

To connect with a financial expert on HOW.EDU.VN:

- Visit the website: Navigate to HOW.EDU.VN.

- Browse the directory: Explore the directory of financial experts, filtering by specialization, experience, and credentials.

- Review profiles: Read through the profiles of potential experts, paying attention to their qualifications, areas of expertise, and client testimonials.

- Contact experts: Reach out to experts who seem like a good fit for your needs, either through the website or via the contact information provided.

- Schedule a consultation: Arrange a consultation to discuss your financial goals and challenges.

5.3. Benefits of Consulting with Experts on HOW.EDU.VN

Consulting with financial experts through HOW.EDU.VN offers several advantages:

- Access to top talent: Connect with leading financial professionals from around the world.

- Personalized advice: Receive tailored guidance based on your unique circumstances.

- Convenient communication: Communicate with experts through various channels, including video conferencing, email, and phone.

- Secure platform: Utilize a secure platform to protect your confidential financial information.

- Affordable options: Choose from a range of experts with different fee structures to find an option that fits your budget.

6. Case Studies: Financial Success Stories

To illustrate the benefits of expert financial consultation, let’s examine a few case studies of individuals who have achieved financial success with the help of advisors from HOW.EDU.VN.

6.1. Retirement Planning: Securing a Comfortable Future

Challenge: A 55-year-old professional was concerned about whether they had saved enough for retirement and needed a plan to ensure a comfortable future.

Solution: The individual consulted with a retirement planning expert on HOW.EDU.VN, who helped them:

- Assess their current financial situation and retirement goals.

- Develop a retirement savings plan with realistic targets.

- Optimize their investment portfolio for long-term growth.

- Explore various retirement income options.

Outcome: With the expert’s guidance, the individual gained confidence in their retirement plan and is now on track to achieve their financial goals.

6.2. Investment Management: Maximizing Returns

Challenge: A young investor wanted to maximize their investment returns but lacked the knowledge and expertise to make informed decisions.

Solution: The investor connected with an investment management expert on HOW.EDU.VN, who helped them:

- Understand their risk tolerance and investment objectives.

- Diversify their portfolio across different asset classes.

- Identify promising investment opportunities.

- Monitor their portfolio’s performance and make adjustments as needed.

Outcome: With the expert’s guidance, the investor achieved significantly higher returns on their investments while managing their risk effectively.

6.3. Debt Management: Achieving Financial Freedom

Challenge: A family was struggling with mounting debt and needed a strategy to regain control of their finances.

Solution: The family consulted with a debt management expert on HOW.EDU.VN, who helped them:

- Assess their debt situation and create a budget.

- Develop a debt repayment plan.

- Negotiate with creditors to lower interest rates.

- Explore options for debt consolidation or debt relief.

Outcome: With the expert’s guidance, the family was able to reduce their debt burden and achieve financial freedom.

7. FAQs About the Shilling and Financial Consultation

To address common questions about the shilling and financial consultation, here are some frequently asked questions and their answers.

7.1. How much is a shilling worth in today’s money?

Converting the value of a shilling to today’s money is complex, but historical inflation calculators can provide a rough estimate. Depending on the year, a shilling could be worth anywhere from £1 to £5 in today’s currency.

7.2. Why did Britain decimalise its currency?

Decimalisation was intended to simplify the currency system, improve efficiency in commerce, and align Britain with other major economies.

7.3. What happened to the shilling after decimalisation?

The shilling was effectively replaced by the five-new-pence coin (5p), which had the same value.

7.4. Is it worth collecting old shillings?

Old shillings can be valuable collectibles, especially if they are in good condition or have historical significance.

7.5. How can a financial expert help me?

A financial expert can provide personalized guidance on various financial matters, including retirement planning, investment management, debt management, and tax optimization.

7.6. What are the benefits of consulting with experts on HOW.EDU.VN?

HOW.EDU.VN offers access to top financial experts, personalized advice, convenient communication, a secure platform, and affordable options.

7.7. How do I choose the right financial expert for my needs?

Consider your financial goals and challenges, and then browse the directory of experts on HOW.EDU.VN, paying attention to their qualifications, areas of expertise, and client testimonials.

7.8. What should I expect during a financial consultation?

During a consultation, you should expect to discuss your financial situation, goals, and challenges with the expert, who will then provide personalized advice and recommendations.

7.9. How much does it cost to consult with a financial expert on HOW.EDU.VN?

The cost of consultation varies depending on the expert’s experience, specialization, and fee structure. HOW.EDU.VN offers a range of experts with different pricing options to fit your budget.

7.10. Is my financial information safe on HOW.EDU.VN?

HOW.EDU.VN utilizes a secure platform to protect your confidential financial information.

8. Conclusion: Connecting the Past with the Future

Understanding historical currency like the shilling provides a valuable perspective on economic principles and the evolution of financial systems. However, when it comes to navigating the complexities of modern finance, seeking expert consultation is essential.

HOW.EDU.VN connects you with leading financial experts who can provide tailored advice and guidance to help you achieve your financial goals. Whether you’re planning for retirement, managing your investments, or seeking advice on debt management, the experts at HOW.EDU.VN are here to help.

Don’t navigate your financial future alone. Contact HOW.EDU.VN today and connect with an expert who can help you achieve financial success.

Address: 456 Expertise Plaza, Consult City, CA 90210, United States

Whatsapp: +1 (310) 555-1212

Website: how.edu.vn

A collection of old British shilling coins, showcasing the historical craftsmanship and design, valuable to numismatists and historians, reflecting the economic and cultural heritage of the United Kingdom.

Historical scene of a trade shop illustrating the items and their relative costs, providing a context for understanding the purchasing power of currency like shillings, and the daily lives of people in the past.

A close-up view of a shilling coin exhibiting its intricate design and historical significance, embodying the economic exchange medium in pre-decimal Britain, and the craftsmanship of a bygone era.